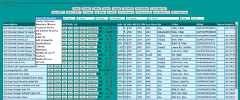

PRE-OWNED ORTHODOX LEASE TECHNOLOGY© IS ESSENTIAL TO THE US ECONOMY: An auto transaction is the most complex sale on earth. A

proper auto lease is eleven times more complex than an auto sale. The complexity of a used vehicle lease is multiplied by additional residual value calculations and the discovery of the real condition of the vehicle at the inception of the lease. Among many intellectual properties created during the last four-decades, ESP owns the only copyright for Used Vehicle Leasing Systems worldwide, #TX4498218 © 1994. The industry and American consumers are readily equipped with used vehicle lease programs to solve problems.

A. TECHNOLOGY: An auto transaction is the most complex sale on earth. A proper auto lease is eleven times more complex than an auto sale. The complexity of a used vehicle lease is multiplied by additional residual value calculations and the discovery of the real condition of the vehicle at the inception of the lease. Among many intellectual properties created during the last four-decades, ESP owns the only copyright for Used Vehicle Leasing Systems worldwide, #TX4498218 © 1994. The industry and American consumers are readily equipped with used vehicle lease programs to solve problems. Fold This...

(Click a logo to review program details.) |

|

|

Auto Lease Auctions is the premier technical solution, a culmination enveloping more than forty-three-years of auto-lease sales & software engineered under the direction of the leaders of the world's greatest lessors. Buyers, sellers, lenders, and vendors can do anything at this 3-way-bidding peer auction from the comfort of their computer console. The Auto Lease Auctions, Inc. website is a workshop, sandbox, and utopia marketplace. ALA is an aggregate of unbiased, multilateral complex-event--processors chained in an order according to user type and input. The system©, and every module in it, are jointly and severally portable for any lawful purpose. You really need to see the domain to grasp and control the potential and power of this ultra-high-tech IP.

Ultimate Buyers' System - Shoppers save time and money, and get the vehicle they really want at Auto Lease Auctions. Anyone can request searches & quotations on any number of vehicles for comparison and consideration. ALA locates dream-cars in the vast inventories of the wholesale, dealer-only auto auctions where the selection is the greatest, the condition is guaranteed, and the prices are fresh.

Personal transportation is everyone's single-most expensive item in life. Leasing is not for everyone, not good on every vehicle, and costs more in some geographies and circumstances; but proper leasing costs way less in most situations and will save around $200,000 per person during an average driving lifetime. Therefore, every vehicle, driver, condition, and contingency should be carefully studied every time an acquisition is contemplated. Auto Lease Auctions is a fully automated, full disclosure matrix marketing system© where buyers can tailor and compare personal/fleet options and make decisions 24/7 prior to seller/lender interaction.

Every shopper is furnished with a myCarQ© workspace, POP email, phone, text, fax, and more to buy, lease, sell, or trade upon becoming a member, which costs nothing. Shoppers become members when they submit a driver's profile comprised of eight non-personal entries used to customize their quotations and determine their personal best deal. Buyers sell themselves after reviewing the facts contained in eighteen reports on each proposed transaction.

Auto Lease Auctions is also their research center for retailing personal vehicles and trade disposal with or without equity as described in the Deficit Elimination System© below. ESP was one of the first companies to code the Millennium Digital Commerce Act back in 1994, so different and better than any other website, buyers can safely complete a lease transaction online under the full protection of the law.

Ultimate Sellers' System - Auto sellers get exactly what they want from ALA, which is a volume of profitable transactions with no investment, no work, no risk, and no hassle. Nothing like an Internet sales department, much more complete than the best classified advertising site, and the opposite of lead-generation websites, AutoLeaseAuctions.com delivers complete deal packages via a Dealer Participation Agreement with a Virtual Fleet & Lease Office© defined below. Additionally, licensed auto dealers can lease a Showroom Selling System© and/or lease ESP's Virtual Leasing Dealership© also defined below.

Auto sellers also have a multi-function workQueue©, staff profiles, full RingCentral® communications integration, and several tool-sets in the ALA marketplace. Sellers – including dealers, private-sellers, remarketers, and VFLO© owner/operators – post listings on ALA with a program called an Ad Maker Pro©. AMP© simultaneously creates up to thirty advertisements, and produces programs such as the AutoSentry© greeting system, the Virtual Auto Salesman© and the Online Sales Desk©. Each listing provides customers (not prospects!) for the whole model line by associating vehicles as they arrive at auction while the ads run.

NetWorkForce™ - Anyone with basic computer skills and a clean PC can operate this system and manage the outcome efficiently from any high-speed Internet connection. ALA includes full training and management software and procedures with payroll and continuing education for remote research analysts and sales secretaries. See AutoEconomics.com and AutoFinacialAdvisors.com below for more information.

All-in-all, there are twenty-five "buyer-types", each with its own demographics, workload, profit, and benefits. The system© identifies each shopper at the threshold, assigns a ready, able, & willing (RAW) number to each, then places them in order of viability in the senior analysts' workQueues©. The RAW is automatically adjusted as events occur, which establishes an excellent customer/inventory/funding management system, which enables expert output from non expert employees.

A good deal has to work out for everyone, or it falls apart leaving the seller to pay for the attempted expense. ESP's online sales strategy is based on consumers making intelligent, informed decisions in their personal time-frame. Therefore, the marketplace constantly monitors the vital statics of visitors and notifies the staff via email or text with information about how and when to close each sale or lease.

This platform is a sandbox, proving-ground, and regulator for the industry to design, test, and expand economic solutions:

- What if all used car leases were written by one company who was also responsible for residual-value losses?

- What are the benefits of leasing classic cars - 1966 Chevrolet Corvette Stingray Convertible LT2?

- What if a Manheim Auto Auction vehicle inspection and guarantee was mandatory for every UVL?

- What are the effects of leasing older models, especially high-end, low-mile beauties?

- Would the economy benefit from longer lease terms and/or lease extensions?

- Is there a legal way to trade an upside-down vehicle without a loss, cost, roll-over, or future liability?

Ultimate Lenders' Solution - ESP technology provides lease-lenders with a no-to-low cost medium for distributing & managing lease programs in a controlled area. AutoSentry© ensures a low look-to-book ratio. Real time residual calculation, fair early termination policies, and the Deficit Elimination System© ensure no losses ever, thereby a great reduction in cost of risk management.

Economic Tsunami Solution - Forward-thinkers, industry-leaders, economists, and investment advisors know the prevalent glut of high-priced lease-return vehicles flooding the market is enough to wreck the economy worse than ever before; we know bigger waves are coming in the next three-years; and we know incentivized leasing must continue for now or the economy will crash immediately. At present, ESP is the only profitable solution for the prevailing problems by providing technical solutions, manpower, and automated marketpaces. For the future, Economic Solution [Intellectual] Properties are a melding of new & used, good & bad leasing to stabilize the economy once and for all. ESP is also the machinery for calming the off-shore super-tsunamis before they make land. Please read about the incentive-intervention programs below.

You don't have to turn on all the lights to see enormous opportunities to save big as a consumer, and earn a lot honestly as a seller, lender, lease professional, or as an auto lease auctions administrator. Contact us through the Action & Resource Center for more information on this, or to set up a personal online meeting to discuss employment, income, qualifications, workload, or even setting up a new marketplace with our three-way bidding software.

|

|

|

In addition to a legal lease assumptions, and as a replacement for rolling inequity into a subsequent vehicle lease, the Deficit Elimination

System© is a highly profitable intervention service to payoff any amount of trade deficit without a cost or loss to any party. DES©, which has been up-and-running at Auto Lease Auctions & the US Motor Club for many years, solves the immediate problems for the upside/down driver, the over-extended lender, and the unaware residual-value insurer by generating a volume of wholesome business on the same or similar year, make, and model automobile. Part of the profit of each new transaction is used to pay off the deficit, then the original vehicle is marketed fairly through lease, retail, or wholesale means.

DES© is quadrupaly-fruitful. Higher deficits require a higher volume of "spin--off" transactions that generates more profit for the VFLO© program operators and the lenders that fund the new business. Recognize the added benefit for the industry and the economy as a significant reduction of off-lease vehicles of that type in the area, which enables and encourages a number of new-vehicle sales/leases of that type. Here is how it works:

- The driver submits a Lease Analyzer Form or a Loan Analyzer Form

- The analyst researches:

- the customer's payoff compared to the current value to find the deficit at wholesale and retail levels, and decide the buy-down amount. I.e., a deficit of $7,500 would necessitate at least 10 spin-off transactions each donating $750 of their profit.

- the cost and availability of similar vehicles at auctions in the area. I.e., all Camaro's, Mustang's, & Challenger's of the same year & two year's newer would be included.

- An orthodox lease is constructed with the payoff as the capital cost.

- A lease is made-up for the same car at auction with the current wholesale value as the capital cost.

- An Auto Lease Auctions Listing© is made with the "Lease Me Now" payment equal to retail (#3) and a "Minimum Bid" payment equal to wholesale plus fair profit (#4).

- The ALA Listing© is promoted by various means listed in the Origination section of the VFLO© Operator's Manual.

- ESP attaches a unique-number to each visitor's account when they land on the Listing©. Bids less than the Lease Now amount are offered a better car at auction for a lower payment than they bid. The auction car is better because it has lower mileage or is newer, and has a guaranteed condition report from the auction.

- The capital-cost of the original-vehicle lease is reduced by the donation from each spin-off transaction, and the ALA Listing© is republished with a lower Lease Me Now payment until the offer attracts a consumer or the vehicle can be sold for wholesale at the auction.

ESP is known for developing software that turns liabilities into assets. The DES© is a chief example of averting disaster by chopping down waves of unorthodox lease return vehicles early and spreading out the time vehicles arrive at auction. There are millions of candidates; each campaign develops an ever-growing number of sales with referrals and repeat business.

If you are upside-down and want to get out of your current vehicle, please visit the Sellers Page at Auto Lease Auctions, read about the deficit elimination system, select analyzer form, follow the instructions, and wait for our reply. Please also know FVLA has a second method to get you out without a cost or a loss, which will be explained in our report, on an individual basis.

If you are a seller, lessor, or auto sales professional with a list of qualified, upside-down clients who wish to trade, or have other interests in the DES© tool please contact us as soon as possible through the Action & Resource Center.

|

|

|

The Virtual Fleet & Lease Office© is a stable platform for practical application of pre-owned orthodox leasing at every level of the automobile ecosystem. Historically, lease-lender bankruptcies and dealer leasing system failures were caused by sales staff turnover after training and by organic changes in our clients' dealerships - like going public. Factory lease incentives dominate the showroom since the financial crisis. Today, UVL has no representation at the point-of-sale in franchised dealerships. Manufacturers' desire and ability to incorporate UVL into their marketing plan are slim and none. In other words, the chance of success by traditional implement of the used-car leasing solution at the dealership level is very low, would be extremely expensive, and take a very long time.

“You will never be successful trying to fix the sales you lost because you can never know what you or somebody else did wrong. To be successful in auto sales, you have to focus on the sales you made, see what you did right, and replicate it.”

- Bob Catterson, Auto Dealer, Trainer, TV Personality

VFLO© provides the solution to the whole industry as a standalone, enterprise business like a franchise, except better. With a VFLO© you can write thousands of pre-owned orthodox leases to the vast unserved market sectors; without it, you cannot write even one. The technology is dynamically different and eminently better for each and every party involved in complex auto-transactions, be it a lease, loan, or cash deal, online or in person. This is an electro-mechanism that converts complicated auto-financial problems into reformed commerce with enormous savings of money and time. It is a no-cost solution for the industry because the dealer's profit, the entire expense and profit of the Owner/Operators' and their employees, is garnered from the savings it creates.

“You will never be successful trying to fix the host of system installations that failed. To be successful in the computer business, you have to create a pure host and replicate it.”

- Tony Goodhardt, PSE of ESP

Since VFLO© is the paragon for practical application of pre-owned orthodox leasing, ESP need only concern itself with the cost, distribution, and use of the pinnacle program. To facilitate rapid deployment, the VFLO© website is equipped with a cost & profit analyzer and a complete set of documents to apply, sign-up, and get training online.

To make it fast, easy, and fun, ESP leases the Virtual Fleet & Lease Office© to the owner/operator with a written guarantee of usability and profitability, so there is no initial cost and no risk to obtain the selling system©.

Another way to get a VFLO© of your own is enroll in the accredited Auto Economics College Curriculum, which has no tuition. You are furnished with a VFLO© to build while you are earning your degree, and keep until your retirement. You and your staff will work with real clients, vehicles, funding, et cetera, so you are paid full wages while you are in college. By the time you graduate, you have a nice portfolio, employees, established business with contacts, retirement fund, and your earnings, which will be around $800,000.00, which is quite a swing away from the normal Ivy League graduate who emerges without a job and about $200,000.00 of debt for student loans.

“Go to the Virtual Fleet & Lease Office© web site, Section IV. See how much you can make.”

Software leases, like for VFLO©, are ESP's primary source of income. These debt-securities combined with our copyright, commercial intellectual properties, and intellectual capital define the value of ESP's stock, which is vitally important for provision of direct auto-lease funding.

†You don't have to open all the doors to find incredible opportunity, education, and wealth at VFLO©. Please visit the Virtual Fleet & Lease Office©, register, read the text, fill in the cost and profit analyzer, review the contracts and agreements, and/or contact me through the Action & Resource Center for more information or a personal visit online.

|

|

|

AutoEconomics.com includes eight articles on the front page and covers thirty-four topics in the knowledge-base.

We learn home economics in primary school, and business economics in post-secondary, why is auto economics not taught in any college when automobiles are the single most expensive item in life and business? Did you know the automotive loan & leasing industry is the largest consumer finance business in the world – 3.19-times greater than real estate mortgages? After four-decades of obtaining, training, and maintaining lessors, sellers, bankers, and lessees, ESP has perfected a certified, then accredited auto economics course for users of its technology and distributors of its direct orthodox auto lease funding.*

If you are going to drive, you need this education to save $1,000's every time you acquire an automobile, $200,000.00 during an average driving lifetime. If you want a certified, then accredited degree in economics without paying tuition and a high-paying career in automotive trade and finance, the auto economics curricula is for you. Check out EXTEMPLAR UNIVERSITY. If you want to own and operate a enterprise business, here is where you can get one along with your degree without a cost. How about a master in auto financial advisement with which you can serve funding and billion dollar projects to consumers and auto industry entities around the globe? Or, even get a grand masters degree in auto economics and leasing so you can teach and receive full benefit of the university's returns.

EXTEMPLAR UNIVERSITY Enroll today online... Not an apprenticeship or an internship, this is a school of practical application. Students are paid full wage to complete their studies by working in the industry online. The best education comes from doing and teaching others to do business, which is the Standard operating procedure at the new Bridge & Gate University, part of the Fair Vehicle Leasing Association. Graduates emerge from school with their earnings, their own client list, a registered franchise, and securities instead of a student loan debt. The university maintains a fiduciary control of every company through the ESP www.AutoFinancialAdvisers.com masters domain and provides services to each graduate throughout the lifetime of the business they created together. At the owners' age of sixty-two, the enhanced, enterprise is passed on to an approved/qualified person who may be related; the owner/operator keeps a percent of the stock and all of their earnings for their retirement and healthcare.

By the numbers: Section IV of the Virtual Fleet & Lease Office© business (www.VFLO.world) is a Cost & Profit Analyzer (CPA) that predicts, and guarantees, income for the student VFLO© owner and every employee during the build, launch, and orbit of each corporation. The Auto Economics curriculum enables each student to build a team of five research analysts in the first month of school. If each research analyst produces a minimum of ten transactions per month, with $700 minimum profit (EBIDTA), the student's first year gross income will be $420,000.00. 600 transactions per year is a very reasonable number due to historic records, the nationwide marketplace, and access to the vast Manheim Auto Auction inventory. $700 profit is a conservative amount after employee payments, which are flat commissions, and a percentage paid to a dealership close by the consumer to make the physical delivery.

The syllabus includes a range of related items like pro se law, how to protect yourself, your employees, clients, and assets under law. Students will learn about securities and how to leverage assets in addition to governmental roles tied to the industry. This earn-as-you-learn attribute abates the need for family funding, outside funding, and student loans. The income exceeds the cost of the finest ivy-league education, which can be obtained semi-simultaneously without an overwhelming schedule. The quality of education is greatly enhanced even though the time it takes to obtain your degree(s) is significantly reduced. Essential financing, education, intellectual properties, and job placement all come from the single act of attending this online college. The quality of life of the student, their family, and employees is elevated by maintaining a remote workload with plenty of time off. The ESP technologies create the most desirable circumstance where education and work revolve around life without disrupting income or the in-flow of knowledge. Self esteem evolves with the knowledge each graduate is a leading participant in the true recovery of the real economy of the USA. Check in the box by "Seeking enrollment in the Auto Economics Bachelor's, Master's, and/or Grand Master's degree programs." on you FVLA membership application form.*

The auto economics curricula are portable for the benefit of education facilities worldwide starting with middle schools (Grades 7-9) and accepting enrollment by people of any age. This career opportunity lends itself to individuals who seek remote employment including homebound, elderly, very young with adult supervision, infirm, even bed-ridden. Even students and graduates of other universities may enroll to earn the income to pay off their student loans. Participating universities who add this curriculum benefit in great amounts of new income, sustained income, and revolving revenue. Non participating universities who recommend the AE course as an externship benefit from rich students who can afford the best education they offer and have the time to focus on their studies.

The Fair Vehicle Leasing Association is creating the Bridge & Gate University with the ESP license to deploy the Auto Economics curricula. It is reasonable to enroll 5,000 students per year at each participating university. The revenue comes from transaction fees and portions of auto lease funding.* In example, a participating university fostering 350 students, each with their own VFLO© employing five research analysts each performing ten transaction per month will earn approximately $53,750,000.00 per year. After graduation, the same group effort provides the participating university with about $7,350,000.00 per year until retirement for continuing education, administration oversight, and support. Of course, each graduate VFLO© owner/operator may employ as many as seventy-five RA's, and each RA may process 100 fleet-transactions per month or more in the cascade of progress. School leaders who are interested in the program can get more information and personal contact by checking the box aside of "University interested in auto economics curriculum participation." in their FVLA membership application form.

* Anyone age twelve (with parental/guardian permission) or older may apply. Enrollment is granted on order of registration. Initially, during the launch of FVLA (as of 04/03/2025), enrollment is limited to the amount of funding available and state, federal, and international registrations and accreditations obtained. Register as soon as possible, show support, which will encourage fair lease fund investment and regulators authorizations sooner.

†Contact us by filling in the appropriate sections in the Action & Resource Center section below. Learn how to enroll in the curriculum and see about the parameters of this special educational tuition-free degree. We are just a few steps away from accreditation and starting the best college ever, so get enrolled because we will be serving students in order of enrollment regardless of prior education, age (over 12 with parental consent as applicable), race, creed, religion, faith, nationality, etc.

|

|

|

Auto Financial Advisers is an orthodox lease certification program. The website is a placeholder for enrollment, training, certification & registration. Certified leases are an up-sell product and a valuable service to the consumer, lender, and residual value insurance company.

Only certified advisers can approve a lease contract when ESP is providing the funding. Certified Auto Financial Advisers are paid to review leases before the lessee takes delivery and ensure the lease kit is in compliance for funding. Auto Lease Adviser provide additional protection for residual value insurance, and they may guarantee certain aspects of the driving-plan, like early termination services to the consumer for a nominal increase in monthly payment. AFA's are paid sizeable fees, and sometimes royalties, but may have to repay an amount for damages arising from errant authorization or failure to provide services.

Contact us to learn about this important position of trust and how to enroll in the master's curriculum. Check the box next to Auto Financial Adviser and/or request a personal online meeting with us in the Action & Resource Center section below.

|

|

|

Beginning in 1998, on request of a Manheim Marketing Strategist at the time Cox Automotive purchased AutoTrader.com, ESP produced UVL promotional material for the consignors' use at auction and a retail lease advertising kit & leasing service to transcend to the auction buyer/dealer. Because of the limited number of models available for Pre-Owned SmartLease®, awareness of eligibility/profitability and retail promotion of those SmartAuction® vehicles are germane to our company. Therefore, we have revamped and improved our wholesale lease products and services:.

- Auctioneer text announcing availability of a lease on the vehicle with specific payments which were pre calculated on the consignor's opening bid plus a specified profit for the buying dealer. "If you bid $XX,XXX.00 for this unit and sell a lease payment of $XXX.00 your gross profit will be $X,XXX.00..." This process can be easily replicated at online auctions like SmartAuction®, OVE, and MOL.

- Accurate lease text similar to the auctioneers' text for the consignors comments section of the presale listing online.

- "Leaseable" interactive widget badges are click icons for each online listing that allow auction buyers to plan retail lease sales on various structures and plan advertising for the unit before they bid.

- A dashboard handbill stating lease availability, credit tiers, terms and conditions, omitting specific payment information,for use while the vehicle is in transit and before and after it is in the lane. Paper products refer buyers to an 800 number for more information.

- The wholesalers kit has a complete retail lease promotion package for the buyer and leasing service including:

- Lease awareness materials that go into the vehicle for the retail staff, management, and shoppers to observe and get educated in the right way.

- A two-sided rear-view mirror hanger advertising lease payments in comparison to finance with a down payment on A-tier credit, lease availability with credit tiers/required disclosure, and lease quotation service 800 phone number. This tool has been known to bring in drivers from the street and into the car.

- 12 planned-response advertisements for the local area, showroom, and lot. Wholly described in the Origination (Section I.) of the VFLO© Manual, these promotions bring in only qualified high-yield targets and let the staff know what the shopper is thinking so they know how to close them. Subsequent auction purchases automatically happen to fill the needs of those prospects.

- Internet lease promotions include interactive "Lease Me" icons for online inventory which cause shoppers to sell themselves. Notifications with individual vital statistics are sent to the staff so they know when the shopper is online and how to best serve them.

- Of course a listing in the Auto Lease Auctions (described above) is included. Customers are easier to process to full satisfaction online. Customer satisfaction usually includes the purchase of more "dream-cars" and commercial vehicles at auction.

- Ally Dealers are offered a full outside Virtual Fleet & Lease Office© service to ensure mega-high closing-ratios on the auction purchases.

- Described here by clicking the "DEALERS" link above, the VFLO© outside sales service generates retail, commercial, and municipal fleet leases on pre-owned vehicles by using 15 Seek n Sell Missions© and 18 ultra-high-tech closing tools. We have leased fleets of used cars to accounts such as The American Cancer Society and Decorating Den since 1976 by researching batches of lease return vehicles at auctions.

All in all, these products and services generate a titanic volume of short-cycle repeat business, which requires an enormous volume of repeat purchases at auction on a schedule that matches the incoming waves of eligible off-lease units. Reference for this platform from 6 dealers and bankers who used the process and equipment during the last 40-years is available upon request. Further, a live demonstration is readily available. Always feel comfortable contacting us at anytime.

|

|

|

ESP's Showroom Selling Systems© (SSS) are the seventh generation of NVL software first installed in dealerships in 1985, upgraded with UVL in 1994, converted to a web-server format in 1998. This is a front-end, manager-closer selling system that produces buy vs lease information in print for shoppers who are in the dealership. It prints promotional material for the vehicles, showroom, and local area. SSS© is for franchised dealer used-car sales desk use only. All others, see the VFLO© and the Dealers Online Selling System©, which is made for franchise dealership Internet department's use.

- This primary use of this system is by auto sales professionals at step four, negotiations, in the typical Key Royal > Road to a Sale" after the manager determines the shopper is qualified to lease if they so choose to do so. Instead of haggling over price and trade values, the salesperson presents the buyer with an A/B buyer's order, full-disclosure finance payment with required down payment on the left; full-disclosure lease payment on the right, with lawful price, trade and government regulated information included; and the agent says nothing.

- Also known as the silent selling system, it prints lighted rear-view mirror hanger advertisements. The in-vehicle ads are special because they generate lease business without ruining finance business, which had been a problem forever before.

- The SSS© is used recover lost market sectors in the dealers local area, namely 29% of the 89% of shoppers who left the dealership without buying a car during the previous six-months.

- The Deficit Elimination System© is included, which enables profitable business with local consumers who are so buried in their current car that they cannot trade through conventional means. DES© taps the largest market segment - about twenty-seven million American drivers - where you have no competition.

- Used vehicle leases are also presented to service department customers to abate the high cost of repairs as stated in Part 2 of this document and the Origination Step of Section I "Eight Steps On The Road to a Virtual Sale" in the VFLO© Owner's Manual.

- The system is used to receive and process shoppers who were attracted by specific local area lease promotions like college programs and print media - again with provisions to protect loss of finance payment buyers.

- The Showroom Selling System© multiplies profits by notifying clients and encouraging short-cycle repeat-business.

This system runs independently of the house system and may be used to manage "rolling inventory" and process lease information for a local "dream-car locating service." Training is included, the system can be leased or paid for with per-deal fees, with guarantees of accuracy and productivity. The SSS© is for savant leasing professionals and franchise dealerships who demand auto transactions are conducted in the agency.

Contact us to develop a custom proforma online. The Showroom Selling System© and its support programs are ready to conduct business today†. Contact us by showing interest in the SSS© in the Action & Resource Center section.

|

|

|

The Virtual Leasing Dealership© (VLD) is primarily for Internet departments of franchised dealerships to attract web shoppers into the store for processing with their Showroom Selling System© on their inventory. This system is unique among all others because, in addition to special listings at Auto Lease Auctions, it includes:

- "Lease Me Links" for their website inventory pages. Similar to online finance payment quotes, these add-in modules are better because they sell leasing and qualify the shoppers online in the same fashion as Auto Lease Auctions Online.

- "Lease Me Badges", which are similar to Links' but go onto the dealer's classified advertisements at other sites including wholesale listings like Online Vehicle Exchange.

- Special advertising tools for the dealer's inventory where the monthly payment is published instead of the price. In example Craigslist, the 4th largest car shoppers' web site in the world, the best immediate advertising source becomes highly effective with Regulation Z compliant lease advertisements bringing in about eight-times more buyers than price advertising.

- Incorporated "PIPE's", which are special email responders that recognize the sender's origin, then return mail with specific lease information on the vehicle, or a range of vehicles if none was requested, and links to more information, which enters the new client into the dealership's internal AutoSentry© program for qualification and assessment. ESP's PIPE's jump through email safety relay--servers like Craigslist and respond only to (human) public address.

- Campaign advertising material to attract special interest in leasing, like inequitable shoppers for the Deficit Elimination Program©, the college student & parents conference seminar, free dream-car locating service, and Powder-Puff Lease Training Courses held at the dealership.

- Planned Response Advertising Material for local area lease advertising that generates more manageable clients from newsprint, radio, TV, the dealer's web site, and online classified advertising - mass advertising. These promotions drive traffic to a "tube" where non-events are eliminated, later-events are preserved in a schedule, and today's qualified buyers are scored and sorted by a RAW number (ready, able, willing) in a list of things to do by the sales department.

Some accounts are better processed online then brought to the dealership for delivery. ESP furnishes sales tools, dealerQ's, email accounts, special phone numbers, paperwork, and more for both online and showroom sales and leasing of dealer inventory in the local area. These promotions may be attached to professional lease services of a VFLO© for additional manpower to cover busy times, off-hours, and adjacent geographies.

This system runs independently of the house system. Training is included, the system can be leased or paid for with per-deal fees. The VAD© can be obtained with or without the SSS©. Both are built for savant leasing professionals and franchise dealerships who demand auto transactions are conducted in the agency.

Contact us to develop a custom proforma online. †The Virtual Dealership© and its support programs are ready to conduct online business today. Contact us to discuss your needs and compare our front-end products. Click the checkbox by VLD© along with your other interests on the Action & Resource Center section.

|

|

|

Lease-Lender Systems© are multi-source, multi-credit-tier compliance, funding, and lockbox software systems for new and used auto leases.They calculate 360-day and 365-day year contracts. This program to be used by, and installed in, banks & financial institutions and the ESP lease clearinghouses as they are established. The software was developed in 1989 for LEASESERVE USA in Smyrna Georgia during the time of Savings & Loan Companies. This program, who's current status is terminate-stay-ready (TSR), will have a high value to the industry as new & old lenders reenter the UVL arena to benefit from pre-owned orthodox leasing as the solution for the impeding flood of lease-return vehicles.

ESP will establish and maintain a number of negotiable stock certificates in attorneys' escrow equal to cover any potential loss incurred by a compliant lease-lender in the event:

- A vehicle lease funding package prepared by an ESP Selling System© fails compliance and will not cash on presentation to the lender. Losses incurred include earned income and an amount to cover lender's published hourly rate of operation.

- A loss is incurred by the lender at scheduled end of the lease, upon early termination, or repossession termination, of an orthodox lease because the residual value was set too high by an ESP system© affecting the monthly amortization amount. Notwithstanding lessee contractual obligations, after ESP has been granted full access to account information, the leased vehicle information, including driver and lender cooperation in an effort to make a retail disposal, lease assumption, or payoff the lease; for no less than sixty-days, the collateral may be transferred to the lender in an amount equal to the loss upon lender disposal including incidental expense.

- A loss occurs on the account of a lessee who's credit-approval ESP guaranteed after ESP has been granted full access to account information, the leased vehicle information, including driver and lender cooperation in an effort to make a retail disposal, lease assumption, or payoff the lease; for no less than sixty-days, the collateral may be transferred to the lender in an amount equal to the loss upon lender disposal including incidental expense.

- A loss occurs due to an error or omission in ESP's Lease-Lender© or Lender-Lock-Box© systems.

Contact us to develop a custom proforma online. We will also present special introductory offers to the first financiers. The Lease-Lender Lockbox System© and its support programs are ready to conduct business today. Contact us below and be sure to check next to the Lease Lender Lockbox System© on the Action & Resource Center form. Also request an online conference to discuss the default settings and source of business for your installation. Visit the Action & Resource Center form.

|

|

|

Winston Churchill once said, "The farther backward you can look, the farther forward you can see," which is never more true than when speaking of the vehicle leasing industry. We don't have to look very far to find the root problems with indirect new vehicle leasing and discover the solution. The three most important figures for calculating a fair lease are price, money-factor, and the residual value (lease-end-value). If one is contrived, the others are distorted, and the lease is unfair.

DISCOVERY

The rise and fall of a benchmark residual value guide

A franchised auto dealer in Port Angeles, Wash., in the 1950s, Jim Aiken developed a process that became known as indirect auto lease financing... more A franchised auto dealer in Port Angeles, Wash., in the 1950s, Jim Aiken developed a process that became known as indirect auto lease financing. After obtaining a line of credit from his bank, Aiken evaluated lease customers' credit histories, forecast their vehicles' residual values, and collected monthly lease payments. In 1964, Aiken formed Automotive Leasing Group, which bought leases from other dealers. With borrowed capital, customized accounting software, and a mimeographed list of residuals on 20 domestic makes, the Automotive Leasing Group became the dealers' bank of choice.

Aiken's business activities led him to create a lease guide to compile data about residual values that had not been available in a single source. By 1972, the group had 5,000 leases from 250 Western dealers. The strategy gained legitimacy when Security Pacific, the California lender, acquired the portfolio, becoming the country's first bank to offer auto leases. The leasing group's founders retained rights to its software and residual guide. The younger Mr. Aiken, a mathematics whiz who studied economics at Arizona State University, spent five years installing computer systems for bank clients before persuading his father to sell him the lease guide (1977).

In the beginning, when Mr. Aiken was the guide's sole employee, he did everything from stuffing envelopes to calling past-due subscribers. "Over the course of a year, I developed programs to mimic what I was doing on mainframes," said Mr. Aiken, who started on a Radio Shack computer. Since then, Doug has created 379 publication copyrights and become the most revered, feared, and sought after individual in the auto sales and lease industry. Automotive Lease Guide became the voice of authority through the 80's, 90's, and early millennium.

Vehicles that retain their value better cause a lower lease payment even though their price may be higher than their competitors. Getting Aikens to enhance the residual on the cars you make, or devalue the residual values of your competitors would give an incredible advantage to any new car manufacturer. Which, they never did.

"They've not abused their position regardless of our efforts to present information that's favorable," said John T. Treter, the rental sales manager for Ford fleet leasing in Dearborn, Mich.

Sometimes, to popularize a model or gain new customers, auto makers' captive finance companies and some traditional lenders take a calculated risk and disregard the guide's benchmarks. They inflate their own residual values to gain more business. That's what Chrysler, then financially strapped, did early in the 90's with its Jeep Grand Cherokee, a bet that eventually went wrong as prices on used sport utility vehicles fell when the market became crowded with competing models.

"Losses could have gone higher, and the credibility of leasing could have eroded had the Automotive Lease Guide followed the crowd," said R. W. Christiansen Jr., the chief executive of Westar Financial Services, a leasing company in Olympia, Wash. "Doug didn't bend. He helped maintain discipline in the industry. Those who have stood with him have benefited."

Feb. 25 2002 -- Doug William Akien, CEO of Automotive Lease Guide (ALG), announced the promotion of two executives to guide the company's future direction. John A. Blair will become the company's Chief Executive Officer, and Raj Sundaram will become the company's President. "John Blair and Raj Sundaram have successfully guided our company in recent years to meet client and market demands. These appointments will help secure ALG's position as an industry leader today and in the future." Mr. Aiken plans to move into a strategic role within the company.

John Blair took ALG public May 2005, and it was acquired by Dealer Track Holdings, Mark F. O'Neil, chairman and chief executive officer. Mr. Blair left ALG and Dealer Track in 2008.

ALG was purchased by TrueCar® in 2011. 15% ownership was maintained by Dealer Track, which is now owned by Cox Automotive, who also owns Manheim Auto Auctions.

Many market factors in the ALG equations have changed due to the rapid drop in new vehicle sales in 2008, the recession, cash for clunkers, et cetera. The ALG algorithms used prior to 2006 do not apply to today's automotive future values, especially used cars.

August 2017, in the normal course of business, ESP discovered an abrupt and severe change in all ALG used-vehicle residual calculations. All of a sudden, and ever since, most 36-month LEV's are higher than 24-month residual values. Lease-end-values, calculated in June-July, on Mercedes and Audi at $15,816 and $6,204 were then, in August, $3,520 and $1,311 respectively. A few vehicles have ultra high projected values like a Wrangler Unlimited with a 24-month LEV higher than the current wholesale cost. Many residuals are below the minimum allowed by IRS Revenue Procedure 2001-28, making for illegal lease contracts, which have several negative effects and huge liability for all parties.

ESP PSE's immediately contacted ALG's senior VP in charge of operations, Alain Nana-Sinkam, to relate the problems and offer our services and technical solution blueprints without a charge. Several contacts evolved but ultimatily no collaboration was scheduled. ALG seems despondent, uninterested in solutions, maybe they are stalling UVL so NVL residual value exceptions can continue...

The fact is, the only one who can prove the benchmark is wrong is the benchmark itself: Contradiction within its own publications... Assaults on common sense... Contradiction to the Residual Value Insurance Group. $5,000, $10,000, $15,000 differences to the Manheim Auctions actuarial sales reports... Around 5,000,000 over-priced lease-return-vehicles at auction, which in themselves alone can crash the USA economy again if they go unchecked. The madness of errant residuals is the primary cause of today's economic chaos worldwide. Nothing will ever be right in the economy again until this problem is solved no matter who caused it... less

SOLUTION

Sustained, Guaranteed

FVLA's Real-Time Residual-Value Calculators solve the problem for anyone who uses them without a cost, at a profit. Researching history teaches what to do, and what not to do. Discovering this problem, and invoking a solution, presents the opportunity to make vast improvements to automotive lease-end-value projections. Most important, the ESP technology sustains the solution for all parties and the USA economy, so this can never happen again. It's true, if you are currently funding new car leases, the chance for financial failure in the very near future is close to 100%. Worse, financial failure of this type could be recognized as fraud against international investors who are covered by the International Trade Treaties, which means the losses and expenses will have to be covered by the USA taxpayers.

To ESP, circa 1998

“Nobody should be allowed to write residual values unless they guarantee them out of their own pocket.”

Doug Aiken, Automotive Lease Guide (ALG)

180° from ALG, the ESP lease-end-value projections are based on actual auction sale prices for 100,000's of the same make and model, instead of a formula, so they can never be wrong. The data is pulled directly from the auctions at the time the driver requests a quotation instead of recalculating from compiled database tables, which are bound to be stale. In addition to mileage, term, and equipment, our technology factors in variables such as the location where the vehicle has been driven, where it will be driven, road conditions, driver habits such as smoking, garaging, number of passengers, et cetera, driving conditions such as weather, timing of the calendar and model year... Proper lease-end-value projections protect the auto lease funders, lessors, lessees, sellers, and the economy at large. Unlike ALG-based leases, all equity at early or scheduled termination is religiously paid to the driver/lessee.

Vast improvements enabled by the FVLA dynamics cause a profound positive effect on the auto industry while multiplying lessors' income and consumers' savings. The market is doubled by projecting residuals for current through ten-year-old models, and doubled again by leasing those vehicles for longer terms, such as 72 and 84 months, just like auto finance loans.

Again, the market is enlarged by availability to lease motorcycles, boats, airplanes, RVs, antiques, classics, customs, muscle cars, and other motor vehicles. Pre-Owned Orthodox Leasing is the only real solution for a profitable disposal of millions of off-lease vehicles flooding our auctions. Many vehicles in this sector actually appreciat in value, which makes for easy leasing. Captive lessors may to continue their altered-lease marketing plan so as to not crash the US economy.

The economic solution for the auto lease industry is sustained by FVLA's broad use, no-cost distribution of the ESP RealTime Residual Calculator and ESP's money-back guarantees of lease-end-value accuracy. Any FVLA member can use the ESP residual technology to calculate fair, level-yield lease payments regardless of funding source. FVLA places ESP securities in attorney's escrow to guarantee POOL Funding Investors and FVLA Direct Lessors that the ESP residual values are correct. This is in addition to RVI Group residual value insurance.

The Real-Time Residual Value Calculator and its support programs are ready to conduct lease business today. Contact us about integrating this code into your programs, obtaining our guarantees, and to discuss the availability of our front-end systems. Please use the form in the Action & Resource Center section for initial contact. We will respond with complete personal contact information.

|

|

|

Within the rules, regulations, and records of United States of America, pre-owned orthodox leasing is found to be a powerful solution for the real economic problems we face today. This is an enormous opportunity for indirect orthodox lease lenders seeking a higher, sustained return on investment. Above, FVLA offers the ESP Lease Lender Lockbox System© to seasoned lessors who want to run a standalone auto lease facility with their own staff, in their own space. This section describes a second, different clearinghouse system© that enables financiers and investors to profit from indirect funding without the cost and risk of a standalone operation, with more margin, ESP vanguards, special guarantees, and extra insurances.

Introducing the Pre-Owned Orthodox Leasing (POOL) Funding System©, which provides full leasing services to investors with full, real-time investor governance, an automatic lockbox, and 24/7 online monitoring. This technology is an up-fitted aggregate of the software used by GECAL and other hugely successful new and used vehicle lease programs throughout history. Most important, the factors causing the destruction of all our fair, level-yield lessors, including GECAL, are eliminated by this technology. more

Introducing the Pre-Owned Orthodox Leasing (POOL) Funding System©, which provides full leasing services to investors with full, real-time investor governance, an automatic lockbox, and 24/7 online monitoring. This technology is an up-fitted aggregate of the software used by GECAL and other hugely successful new and used vehicle lease programs throughout history. Most important, the factors causing the destruction of all our fair, level-yield lessors, including GECAL, are eliminated by this technology.

- The major investments of time, money, and effort involved in brick & mortar auto lease marketing are eliminated. This results in no errors, no hassle, and more margin. The "up-fit" is a computer connection to all of the Virtual Fleet & Lease Office© Systems described above, which are the error-proof front-end systems that also process the lease compliance, so contracts are ready for funding. 180° from conventional auto dealership sales staff, VFLO© owners & operators coddle their portfolio clients throughout their driving lifetime. The first advantage comes from FVLA/ESP Seek n Sell Campaigns© which target only high-yield, low-risk corporations, professionals, and individuals. As well, the VFLO© operators provide all end-of-term services, be it early or scheduled termination, including vehicle remarketing or disposal. Auto lease financiers enjoy a true, straightforward return on investment; the difference between their cost of money and the lease factor.

- Substantially lower group costs, maximum efficiency, and considerably larger market equals lower consumer pricing, much more margin, and 4x volume. "Aggregate" refers to multiple funding-sources thrive in a harmonious, matrix funding-system to serve the needs of all market sectors (with no or low default-ratio) at a drastically reduced cost and significantly higher profit for auto lease funders.

- This software is essential. POOL Fund investors will never have competition in the used-vehicle leasing arena, which is the largest consumer finance sector (currently unserved):

- FVLA has the only copyright (TX4498218 © 1994) for used vehicle leasing systems and an active legal team to protect shareholders and auto lease financiers from infringement.

- It would take a team of 127 programmers at least 13-years to duplicate these massive programs, and that would be illegal.

- FVLA furnishes these products without a charge, so any would-be copycat will benefit instantly by joining the group instead of undermining it. The group benefits from additional investors.

- Unfair street competition like captive leases with inflated residual values does not exist in the VFLO©'s or independent dealerships' marketing arena. VFLO© operators welcome captive lease competition because those are so easy to beat. Fair leases cost less initially, monthly, at the end of the lease, and the optional purchase price is less. Often, new-vehicle dealers learn about the benefits, then submit scores of prospects who convert to fair leases.

- There is no competition between POOL financiers/investors, VFLO© owners/operators, or anyone in the FVLA network. The market is so vast that every financier can never run out of leases to fund even in special sectors. In addition, the ESP systems automatically route repeat clients, referrals, and return vehicles to the original auto lease funding source for new, additional, and repeat profit.

- The ESP Vanguards are leading-edge engineers who not only design and build the programs, but also use their programs at work everyday with actual customers and real vehicles. The wealth is in the details and timing as they plow the way so the clients, VFLO© operators, dealers, vendors, lenders, and auction personnel have an easier go and richer result. In example, advanced-action programs warn lessees of the cost of upcoming maintenance and repairs then urge drivers to switch vehicles or rewrite their lease causing more lease-lender profit and volume. Another vanguard program monitors lessees' mileage without on-board devices to govern best trade time for a consumer, thereby multiplying return on investment. You may read about all vanguards at VFLO.world above.

- Vanguard technology, constant contact, and marketing methodology enable ESP to guarantee no defaults and no lessor losses in most cases. Extra insurance, in addition to residual value insurance, is included for eminent protection of the auto lease financiers. In both cases, the funder's return on investment is assured by ESP securities placed in attorney's escrow at lease inception.

- FVLA's technology, tactics, and securities create perpetuity in a broader, deeper, and denser spectrum. Since we create and guarantee the lease-end values, we can choose to write longer lease terms and/or older vehicles to extend lessor profits without additional cost. In addition, FVLA plans to lease RVs, motorcycles, airplanes, boats, and other motor vehicles in the USA and Canada to expand the auto lease investor's profit area.

- First time ever "sectional funding" allows financiers to customize their funding offer to specific vehicles, market, or other demographics. This is most useful to captive lessors who need to dispose of their lease return vehicles and automotive groups desirous of leasing only their own inventory.

- I think we all know https and security certificates alone are not going to protect our information online. ESP's super-high-tech lease application and personal privacy policies eliminate the need for FACTA (Red Flag) compliance, its expense, and hassle. No personally identifying data or credit information is received or stored by any FVLA party. The online application is triple encoded as the prospects enter their information, then sent directly to the lease lending source. We do not sell consumer information, of course, and we do not sell advertising space on our web sites. We don't even use cookies. Cookies are crummy, and they provide footholds for ID theft. Since FVLA programs do not accept or hold any personal information, no tortuous, malicious lawsuit will ever be successful against the FVLA lessors.

- Of course, accurate Real-Time Residual Calculators© are essential to the POOL Funding System© operations. The system is fully automated, so no one can entice an increase in their vehicle LEV's or a decrease in their competitors' vehicle residual values. The program details are in the next section above. less

There are no better investments or tax shelters in America than debt-securities – especially level-yield leases, which are annuities-due. Above, we outline technology that provides the ingredients for maximum ROI. Below, we outline the principles and procedures for sustained practical application of fair level-yield pre-owned vehicle leasing with maximum financier profit. more

There are no better investments or tax shelters in America than debt-securities – especially level-yield leases, which are annuities-due. Above, we outline technology that provides the ingredients for maximum ROI. Below, we outline the principles and procedures for sustained practical application of fair level-yield pre-owned vehicle leasing with maximum financier profit.

- All new and repeat leases will be designed and contracted, with earnest deposit accepted, by VFLO© certified lease professionals and reviewed by accredited auto financial advisers then distributed for delivery to a licensed auto dealership close to the driver who has authorized a dealer participation agreement (DPA) with FVLA.

- All automobiles, and most other vehicles, will be purchased from the wholesale auctions after pre-sale and post-sale inspections have rendered a guarantee of condition and the auctions' "deal-shield" seller/buyer protection contract.

- All leased equipment/vehicles will be purchased and paid for, insured, and owned by the Virtual Fleet & Lease Office©, or the participating dealer, at time of delivery, then funding, in compliance with all laws.

- Only sales margin profit and additional rate participation profit will be shared with the delivering-dealer in an amount agreed within the DPA. In the event no authorized delivery dealership is available close to the client, the VFLO© may deliver the vehicle himself, through UPS, the auction, or any legitimate entity having signed a delivery agent agreement online. less

Under the natural laws of financial relativity, contrived lease dynamics have created an immense opportunity for pre-owned orthodox lease lessors and investors. The programs, procedures, and principles above eliminate competition, create enormous profit while solving economic problems, but the pre-owned orthodox lease market can still be lost in the future through complacency, vulnerability, stupidity, and/or greed. more Under the natural laws of financial relativity, contrived lease dynamics have created an immense opportunity for pre-owned orthodox lease lessors and investors. The programs, procedures, and principles above eliminate competition, create enormous profit while solving economic problems, but the pre-owned orthodox lease market can still be lost in the future through complacency, vulnerability, stupidity, and/or greed.

- All FVLA members at every level will refrain from burying the driver and funder by proper pricing and rate participation policies and/or effecting legal lease transfer on early termination. Selling members and financiers will learn that four-times more profit per driver comes from lower prices, payments, and rapid repeat business.

- All transactions are reviewed and approved by a certified auto financial adviser prior to funding.

- All vehicles will be physically delivered in witness of the lessor before the delivery receipt is signed by the lessee; all delivery receipts will be signed before the lease is submitted for funding.

- All leases will contain a legal assumption clause which can be effected multiple times. All FVLA members involved in sales production or lease service will perform assumptions on request of the consumer regardless of the amount of profit or subsequent leases.

- Any equity established during the lease will be paid to the lessee in full upon early or scheduled termination.

- The word "risk" has one-hundred meanings – 1 to 100%. Risk equals zero when the lease can be terminated or transferred without cost at any time with a profit. A B-grade or C-grade credit applicant without a trade will have a lower risk-quotient, pay a higher yield, and trade much more often.

- FVLA will process prospects who are buried in a captive lease or finance contract differently to protect the lease funders, our market, and prevent an auto-economic collapse. The process for using fair leasing to correct a driver's auto-financial health is wholly described in the VFLO© documentation referenced above. The risk to the lender may be increased by the amount of inequity if attached and some options are not available to these portfolio account's. The Auto Financial Advisers fiduciary responsibilities include signing-off on multi-directional understanding of risk, trade options, terms and conditions over and above the 2010 Truth in Leasing Act and FVLE's standard short-cycle early termination policies.

- VFLO© operators are taught to originate business in states where orthodox lease-tax regulation (collected monthly) is practiced. States who charge upfront sales-tax on leases cause initial and persistent trade deficit, and/or disable trade al together, which increases risk to the lessor while decreases revenue to the VFLO© and auto industry. In these cases, some options and services, like early termination through payoff, are available, but may be unattractive. Early termination through legal lease transfer of a super-attractive payment is available, but only attractive to residents of that state. These clients are kept separate in special folders for special services withstanding signed statement of understanding of trade options. FVLA intends to lobby for lease-tax regulation nationwide by demonstrating the economic benefits and providing literary donations to government agencies that enable organic lease-tax regulation. less

The projected income for Pre-Owned Orthodox Lease Funders is excellent – and enhanced by a solid, lawful, single-book tax shelter. FVLA members who are interested in POOL Funding should contact my office as soon as possible to develop a custom proforma with us online. We will also present special introductory offers to the first financiers to contact us. The POOL System© and its support programs are ready to conduct lease business today. Please visit the Action & Resource Center section to checkmark items of interest and make initial contact. We will respond with full contact information. You will have our undivided attention because obtaining essential fair lease funding for our members is our primary objective.

|

RELATED ESP TECHNOLOGIES WORLD CORPORATION COMMERCIAL SOFTWARE:

- S.E.C. REGULATION A & D FUND RAISING PROGRAMS

- BUSINESS RULES ENGINES

- INVENTORY CONTROLERS

- WAGE & HOUR TIMEKEEPERS

- ACCOUNTING PAYROLL, TAXES

- AUTOMATIC LOCKBOX OPERATIONS

- CUSTOM ENTERPRISE TECHNOLOGY

- FOOD SERVICE, RESTURANT & CATERING

- CHURCH AND SHELTER BUSINESS PROGRAMS

- CORPORATE CRIME DETECTION & PROTECTION

Contact below us for details and quotations.

C. FUNDING: Within the rules, regulations and records of United States of America, pre-owned orthodox leasing is found to be a powerful solution for the problems we face today. The computer applications, ample inventory and expert manpower are in place - presenting an enormous opportunity for orthodox lease lenders. ESP is liquefying its assets to fund auto leases as a lender and provide special residual value insurance. We want to take part in this long-term, roll-over income for our shareholders, provide financiers with a model lease-clearinghouse, sustain no-cost lease-program distribution and be a source for investment in the prepared auto-lease bundles. Fold This...

Perpetual Self-Funding

There is virtually no competition in the UVL funding arena. The cause of the attrition is documented - a topic for discussion elsewhere in the ESP domains. Important here is, under the natural laws of financial relativity, unorthodox lease dynamics have automatically created an immense opportunity for pre-owned orthodox lease lessors and investors. There are no better investments in America than debt-securities – especially annuities-due. ESP's technology, tactics and securities create perpetuity in a broader, deeper and denser spectrum with little-to-no risk.

The first advantage comes from ESP Seek n Sell Campaigns© which target only high-yield / low-risk corporations, professionals and individuals. The word "risk" has one-hundred meanings. Risk is eliminated when a lease can be terminated or transferred without cost at any time. Thereby, a C-grade-credit applicant may have a lower risk-quotient and pay a higher yield. This is important because the top-credit-tier targets are incarcerated in unorthodox leases – the only option available to them until now.

In addition to computerized controls, Auto Financial Advisers™ are duty bound to construct wholesome "driving plans" for each client at inception or they can lose more than their commission and their certification maybe revoked. Per account monthly, changes in mileage, status, desire, need or ability to pay are recognized by ESP automation such as Auto Lease Pit Stops© and Auto Lease Checkups©. VFLO© documentation reveals customer service begins at lease inception and lasts throughout the driving-lifetime. Every driver retains their myCarQ© to maintain their account information. Lower-credit, higher-risk accounts require on-board GPS with vehicles status reporting. For 35-years in search of profit, ESP spiders crawl the drivers' databases finding good reason to trade early and report to the The NetWorkForce™ who's perpetual income is based upon such trade.

The risk-factor for new-vehicle leasing is much higher for every credit-tier, increasing significantly toward the end of the model year as prices increase and pent-up depreciation occurs in the moment they become used-cars. Smart investors will notice smart lessors, like Toyota, run lease specials at the beginning of the model-run to avoid this problem. Smart investors should realize the ESP auto-lease funding opportunity is doubly-fruitful as an offset on the balance sheet against investment in unorthodox lease paper where the risk of loss is near 100%, customer satisfaction is around zero and chance for repeat business is based upon financial entrapments, which only perpetuate the financial crises worldwide.

“Tony, nobody should be allowed to write residual values unless they guarantee them out of their own pocket.”

Doug Aiken, Automotive Lease Guide (ALG) - 1998

"As a dealer in Port Angeles, Wash., in the 1950s, Jim Aiken developed a process that became known as indirect auto lease financing. After obtaining a line of credit from his bank, Aiken evaluated lease customers' credit histories, forecast their vehicles' residual values and collected monthly lease payments. In 1964 Aiken formed Automotive Leasing Group, which bought leases from other dealers..." - AutoNews.com

ESP auto-lease funding program is a venue for investors to benefit from indirect financing without direct responsibility for residual values. The Realtime Residual Value Calculator described in Part A develops accountable residual values, which are insured two ways: by RVI Group and by ESP securities in escrow and warehouse for the gap if any exists at scheduled termination. Unprecedented, unavailable to investors in unorthodox leases, this reformation combines the benefits of direct and indirect leasing while eliminating the risk of errant residual projections and the astounding high cost of risk-management several years after the fact.

A secure portal for section lease funding is enabled by the capabilities of the Online Lender Systems© in union with the Virtual Fleet & Lease Offices and other selling systems© linked in Part A herein. Section lease funding has existed since the 1980's when GECAL processed BMW, Mitsubishi and other lease paper along with their own. ESP, a GECAL dealer and computer programmer of all auto-lease lenders at the time, has maintained the multi-lender selling systems© down through the ages. This is particularly important to factory lease lenders faced with overwhelming lease-return inventories. They, or any auto-lease fund investor, may curtail their pledge to certain makes, years, models, rates, risk-factors, dealers and conditions to custom tailor ROI. This is the only known solution for practical application of pre-owned orthodox leasing now being recognized by the industry leaders and investment advisers mentioned in Part 3 above.

Sectional opportunity for dealer groups who wish to fund only leases written within their dealerships is provided by the same software and rule-set.

ESP is glad to be first to invest in this field and proud to use its assets to guarantee success for investors in orthodox auto lease funding. A separate program ( POOL™) has been build for investors and financiers to manage their holdings in auto lease funding activities above and ESP securities below. If your measure is money, take peace-of-mind in this automation, which allows immediate withdrawal of unused auto-lease funds.

ESP Corporate Value, Securities & Collateral

ESP's life-long dedication to creating auto-lease industry solutions is never more evident than when it commits its entire enterprise value to create pre-owned auto lease funding. Historic market-value appraisals prove ESP could lease all 4.4 million off-lease vehicles by itself according to Robert Malt, an accredited business appraiser. By the numbers, only $84 billion need be available to do that. Under federal (SEC) and international (IFRS) laws, the company's intellectual capital will be converted to financial capital at a rate equal to the demand for direct auto lease funding, minus the amount of outside investment for auto lease funding, plus the amount of reserves for guarantees and insurances to indirect auto lessors.

This plan is an example of orthodox acumen where a large amount of intellect and a small amount of revenue totally reform commerce in a major industry:

- The process begins immediately with a Private Placement Memorandum under Title II, SEC Regulation D 506(c) where ESP offers to sell one-million shares of its stock to accredited investors for $5.60 per share, which is twenty-five percent (25%) of the appraised market-value made in 2003 & 2006 by Mr. Malt, Arrow Business Appraisers, Inc.

- $5 million, eighty-nine percent (89%), of the revenue will be used for direct auto-lease funding which,

- earns income, establishes cash flow,

- provides "in-flight data", proves the process,

- immediately adds $1 million in equipment lease debt-securities (VFLO©) to ESP's balance sheet,

- adds $5.61 million in debt-instruments (auto leases) to the company net worth,

- and compels outside investment in pre-owned auto lease funding.

- 11%, $600,000, is spent on intellectual capital including

- human capital,

- relational capital,

- structural capital,

- IP and library improvements and additions,

- merchandising, marketing (prescribed in VFLO),

- legal expenses, shareholder protection, recoverable judgments,

- professional market-value, industrial IP, & IC appraisals to establish present EV,

- PCAOB/IFRS compliant audits, and the cost of going pubic.

- ESP then offers at least 2 million shares to the public through a Regulation A+ Tier 1 or 2 sale at a price established by the enterprise value without market-value and without optimization. The revenue will be used for auto-lease funding and peripheral expense which enable unlimited VFLO© sales/installation and growth. Reg A+ provides an exit for first-responders (PPM) and shareholder trading enhances ESP stock value. 87% of the stock is retained by the company at this point.

- Publicly traded, properly reported securities are perfect collateral in warehouses around the globe, for example. Public stock shareholders' values rise steadily as VFLO© installations increase along with auto-lease funding in a self-perpetuating optimization. Stock values will jump proportionate to indirect auto-lease investor deposits, success of the Selling System© owner/operators and society's opinion of ESP technology as the solution for the auto industry problems, which may lead to lower taxes and overall economic stability.

What is ESP Tech World worth to you?

Fold Part C

|