No one knows more about an industry than the principal software engineers. Abating discussions of issues and their negative effects, ESP describes problems for the sole purpose of identifying the one-and-only solution for all parties, especially those who created the problems while solving economic crises of the past.

Nobody should be stunned by the "tsunami" of 4,400,000 too-high-priced off-lease vehicles flooding the auctions. This is a result of contraventions to the natural laws of leasing depreciating-assets. It is an exhibit of financial relativity. This is not the first time this has happened. Many manufacturers have written unjust residuals since the first Holiday Lease Incentive of 1985. The higher the residual, the lower the lease payment. A high residual is the first ingredient of a deviated lease because that hides high prices, exorbitant fees and significant losses from the lessee, lease-funder and residual value insurer during the term of the lease. Invoking incentives at the end of the model run, when new cars are worth the least and cost the most, exacerbates that part of the problem.

Captive lessors have had little competition since 2000 and no competition since the announcement of the financial crisis late in 2008. Several captive-lease-lenders do an excellent job of marshaling their lease portfolio, but a change to the Truth In Leasing & Adverting laws during 2010 enables unethical organizations to obscure unscrupulous lease amortization and unfair early termination options as shown in tables T7 & T8 above. These seemingly attractive high-bracket leases monopolize fleet & retail consumers; taking away ETO's builds tidal waves into tsunamis like we have today.

You may be unaware of this compounding infraction because no one, not even the chief industry analysts or global economists, has mentioned it in any of many articles published on the subject over the last seven years. Industry leaders are just beginning to grasp the magnitude and make adjustments to new vehicle sales predictions.

Any form of solution is also conspicuously absent from all reports, forecasts and investor advisories except Manheim's 2017 Used Car Market Report by the Chief Economist, Tom Webb (Ret.). ten pages of seventy-four (11%) nominate pre-owned orthodox leasing as the instrument for remarketing the flood, which will soon cause another national financial disaster if it goes unchecked.

“The farther back you can look, the farther forward you are likely to see.”

Winston Churchill

Nobody should be alarmed by this knowledge because waves, like railroads, run in both directions. Often misquoted, the real rule of law from Robert Duke of Bar is, "Ubi peccatum perpetratum est, quae solutio automatice creata est.", which means, "When an offense is committed, a solution is automatically created." In other words, the gluts of lease return vehicles provide an endless inventory for pre-owned orthodox leasing as the first ingredient to the mix:

- Global financiers who invested in unorthodox debt securities should be willing to fund orthodox UVL's to protect their primary ROI.

- Immediate relief for consumers who may re-lease their own vehicles more often, perform a lease takeover or rewrite to an orthodox lease mid term, will evolve in a sizable volume of new vehicle sales.

- A vast human resource has been automatically created to serve lease solutions.

- Auto dealers profit with old-school leasing and automatically regain control of the market.

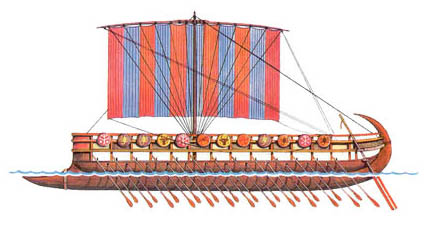

Life, law, money and leasing run in a circle. The laws for leasing were written by the thalassocratic societies: Bahrain, Phoenicians, Liga Teutonica and the Hanseatic League. You will find those laws to be identical to the US Code, Truth in Leasing Act of 1976 and Regulations M & Z. Orthodox leasing is the precedent of every nation on earth still today. The sooner we get back to it, the better. The list of problems resulting from unorthodox leasing is not exhaustive, but coming full circle, the solution of orthodox UVL will be 100% inclusive.

This is not the first time pre-owned auto leasing was used to remarket vehicles coming off new leases. ESP created the Used Vehicle Lease Selling System© (www.copyright.gov #TX4498218) in 1994. That system© was used by several lenders and dealers including General Electric Credit Auto Lease (GECAL) and Coggin Honda Superstore in Jacksonville Florida. Records show thousands of GE off-lease autos were shipped into tent sales where Coggin wrote hundreds of used vehicle leases per month for a number of years prior to their IPO with Asbury Automotive. When our system was removed, the organization never wrote another used vehicle lease and GECAL folded shortly after, thus proving the value of our commercial intellectual property as an off-lease remarketing tool.

“Every adversity, every heartache and failure carries with it an equal or greater opportunity.”

- Napoleon Hill

Now eighteen-years after that, described below in Part A, ESP is the creator, distributor & copyright holder of industrial computer systems to eliminate the problems. We have technical solutions for both wholesale and retail applications. ESP is equipped with the world's only copyright for UVL and ten commercial intellectual properties (CIP's) to enable presentation of pre-owned orthodox leasing (POOL?) at the point-of-sale anywhere in the world from anywhere in the world.

HIGH-TECH HIGHLIGHTS: Our system© for wholesale auction promotion of UVL should be of particular interest and Auto Lease Auctions is the world's only three-way bidding marketplace, sandbox, workshop. Our systems© include a WorkQueue© for every entity and every individual to manage residuals, advertising,origination, listings, sales, leases, trades, budgets, fleets, manpower, affiliates, associations, lease rate incentives, remote operations, receipts, taxes, payroll, funding - even communications by phone, fax, email, text, chats, blogs and unique page relays like vital statistics are included. New last year is Auto Economics.com, a university grade curriculum and AutoFinancialAdvisers.com, an important certification program. New three-years ago is the enterprise Virtual Fleet & Lease Office©, a standalone business that solves multiple problems with facilitating UVL at every level of society. In addition, ESP has over 550mb of code on the R&D shelf (TSR) which can be converted quickly for any legitimate use in the auto-lease industry.

Historic data analysis shows cause, effect and the road to recovery. There is no global currency in the grand plan for man.. Monetary transactions account for only a small part of the economic domain. Therefore, without reservation, part of the ESP solution is liquefying corporate securities for initial lease-package funding, collateral and guarantees to insure profitable participation of all lease-lender, government agencies and the residual value insurance groups.

Yes, ESP has the technology, gumption and the initial net wealth, but the real one-and-only solution is industry participation in practical application of orthodox used vehicle leasing with these assets.